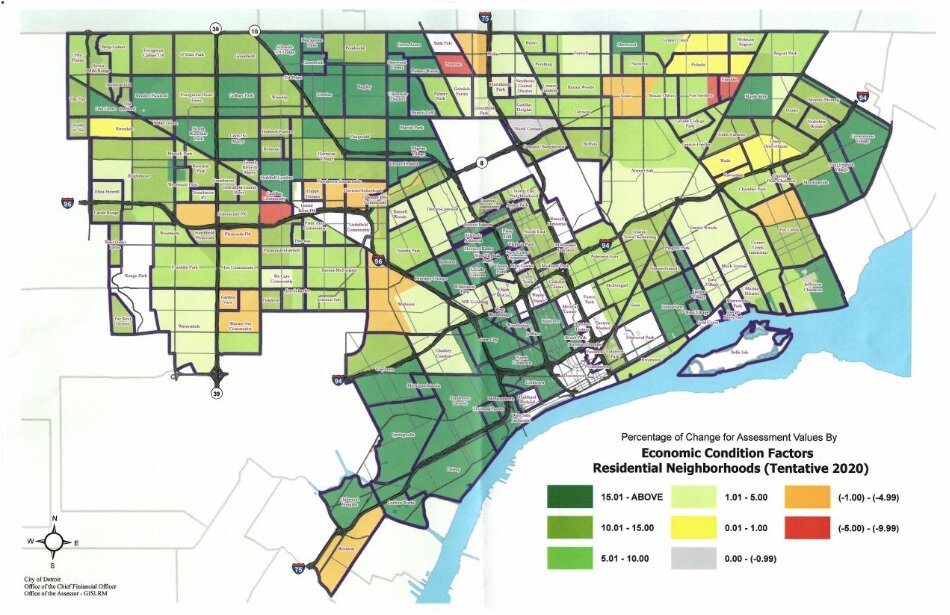

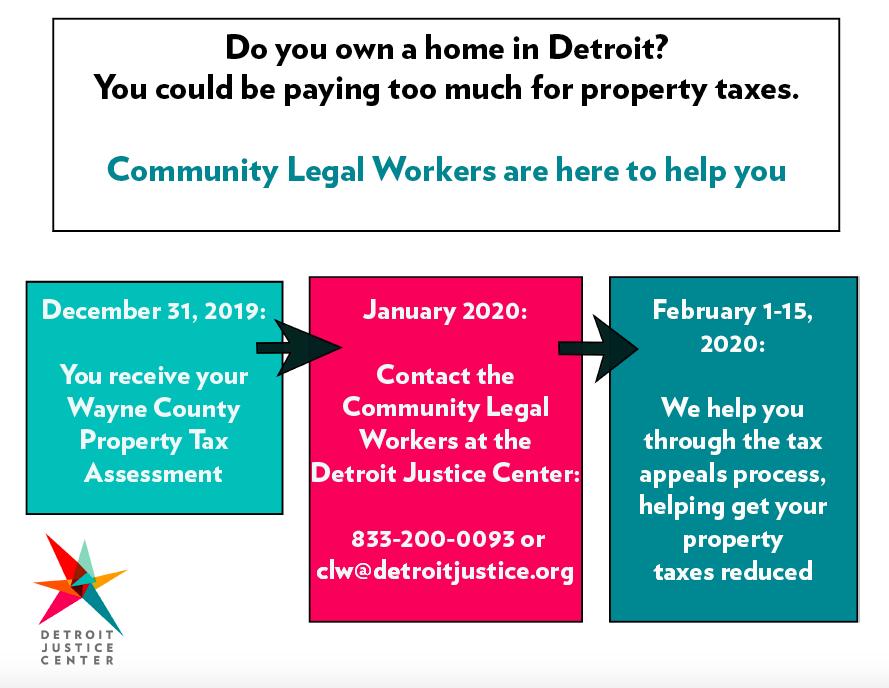

Over the past few weeks, there has been a great deal of reporting on Detroiters being overtaxed on their property taxes to the tune of $600 million. While we have been aware that this was still an issue, the rate at which low-income Detroiters are being over-assessed and then over-taxed is a huge issue. Last year, when we launched the Community Legal Workers program, we did so with the goal of showing that non-attorneys could assist community members with the tax appeal process and make a difference to residents who could be at risk of losing their homes. We had a 100% success rate in getting property taxes lowered for folks who came to us for help and continued the program into 2020. What our Community Legal Workers can help you with is if your property is currently over-assessed. What we are unfortunately unable to do is get Detroiters reimbursed for taxes that they have already paid.

One of the biggest issues coming out of these revelations is that there is no process for Detroiters who have been overtaxed for years to be refunded. Our colleagues at The Coalition to End Unconstitutional Tax Foreclosures released a report last week detailing the issues Detroiters face because of over-assessment and offering potential solutions for how to compensate Detroiters who have lost their homes. If you are interested in working with the coalition to fight for Detroiters you can follow their work here.

If you believe you have been over-assessed and need help with the appeals process, reach out to our Community Legal Workers at CLW@detroitjustice.org or call 833-200-009 before January 31st!